What could possibly go wrong with public markets paying 28x revenue multiples for SaaS companies? One “top tier” VC firm gave a company with $2 million in ARR over $50 million at nearly a $500mm valuation. Two other “top tier” funds valued a company with less than $5 million in ARR at $1 billion. Does a 200x revenue multiple ever make sense?

I had front-row seats through the dotcom insanity as the founder and CEO of DoubleClick. Now, as a Partner with ScOp Venture Capital, I once again have front-row seats in the SaaS market. These front-row seats devolved into a drunken brawl in the mosh pits.

Today’s market looks awfully similar to 2000, though there are some significant differences. During the dotcom crash, DoubleClick lost 75% of our customers. We had $400 million on our balance sheet, so we were in a good position to endure the storm, though at times we weren’t sure the storm would end. Our customers went out of business for two primary reasons: 1. Total dependence on the Internet economy, or/and 2. Ran out of money and could not raise additional funds. The Internet ecosystem was fairly insular, where unproven ideas raised massive amounts of cash and blew it on other unproven Internet companies.

Today, we have a more complicated tech market. We have Crypto, which solves no known problem and creates no value through its algorithmic Ponzi schemes. This market will crash and burn and many scammers, er, innovators should go to jail but will end up in Miami with their canary yellow Lambos. The Internet also had many “cool” technology companies that could never create any value. I was, and now am, often told, “you just don’t get it.” Oh, I got it. May they RIP.

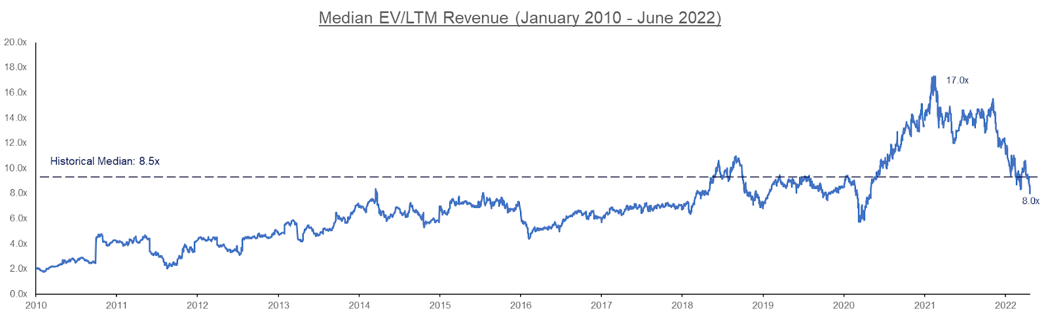

The other part of today’s tech market is an extension of the best part of the Internet, it’s about companies creating real efficiencies and new markets through technology. Horizontal SaaS technologies have created huge efficiencies throughout almost every department across most industries. Vertical SaaS products have transformed or even replaced traditional, inefficient companies with tech companies. In other words, many tech companies are creating real value across a diverse range of industries. In November, investors overvalued those tech companies and are now undervaluing those same investments. Maybe. Nobody knows.

I think overvaluations happen because you compare your company or investment to similar companies and the market as a whole. Sure, the other guy’s company could be overvalued, but how could an entire industry or market possibly be overvalued? Aren’t Wall Street and VCs really, really smart? We were all so brilliant 6 months ago; how did we become so dumb, so quickly? I’m sure human psychology is similar to why people believe in the Crypto scam. My hypothesis? Arrogance and greed. Hubris.

So, what happens next?

Like the Game of Thrones, “A long night” has come. After the dotcom crash, NASDAQ didn’t recover for 14 years. Venture capital deals and dollars dropped almost 90% and took a decade to recover. Your home that went up 20% in value? Gone. Though there are many similarities to the dotcom crash, there are also substantial differences, primarily “real” companies with “real” products with “real” customers. In other words, products that create actual value for traditional industries. I suspect multiples will over-contract until investors remember that fast-growing, recurring revenue companies are enormously valuable.

So what should companies do?

Continue to focus on creating real value for your customers. Make sure you are focused on what you NEED to do rather than what you WANT to do. Canceling a project today doesn’t mean you’ll never do it; it just means pushing it off into a more certain future.

Growth is great, but it’s also very expensive. Unrealized growth will kill you. Only scale channels where you have a very high degree of confidence they can scale. Carefully test new channels before you scale. It’s ok to make small mistakes, but big mistakes will kill you.

You should be in a position with the cash you have to get within spitting distance of break-even because you may have to. If somebody wants to throw money at you, take it. Another alternative is shore up your balance sheet with an inside round at a fair valuation. Don’t be greedy. Entrepreneurs tend to obsess, unreasonably in my view, about dilution. Your job is to protect all shareholders, which may require taking some money as insurance.